Scope of Work

As per the client’s requirement the scope of work gets defined. This could vary from client to client. We give complete freedom to the client to pick and choose his requirement from the below mentioned scope of work

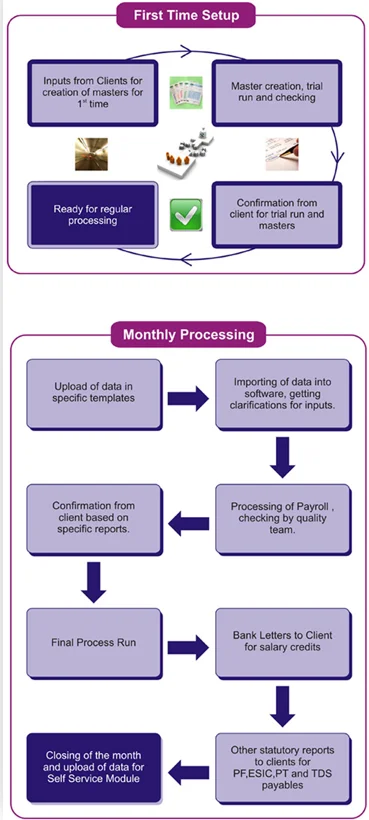

One time Master Setup

- Various Masters –Branch, Department, Designation etc.

- Payroll components with rules

- Employee Master Details

- Employee self-enrollment

- Employee Salary Structure

- Loan Recovery Schedules

Monthly Payroll Processing

- Monthly salary processed based on data provided as per attendance sheet, change in salary structure and other variable components.

- Calculation of TDS based on the proposed investments received from employees

- Audited data with discrepancy report provided to the client for final approval.

- Generation of Bank transfer files for the credit of monthly salary.

- Full and Final Settlement for resigned employees.

- Generation of MIS and Statutory Reports.

- Salary register for the month.

- Salary comparison Audit report.

- Monthly Accounting JV report.

- Monthly TDS Challan payment report

- PF Monthly forms and Challans in electronic & paper format.

- ESIC monthly contribution file in electronic format for uploading on ESIC Portal.

- Profession Tax Challan and reports.

Quarterly Processing

- Updation of monthly TDS challan payment details.

- Reconciliation of monthly TDS challans, with TRACES before creation of quarterly etds files for NSDL submission.

- Audited data with discrepancy report provided to the client for final approval.

- Generation of eTDS returns along Form 24Q and Form 27Q for NSDL submission Year End Processing.

- Investment proof audit (Proposed vs submitted vs rejected), submission of discrepancy report to client for final approval.

- Final Investments record updation and final tds deduction report submission to client for approval.

- Generation of eTDS returns along Form 24Q and Form 27Q for NSDL submission.

- Generation of digitally signed TRACES Form 16 (PART A & PART B) combined in single pdf.

- Annual MIS reports.

TDS Correction, Revise returns filing

- Tds correction and filing of revised returns.

- Analysis of default notice received from tax department and proposing the course of action.

- Drafting of reply to default notices received from tax department.

Investment proof checking

- Checking of 80C investments Other deductions for tax purposes.

- Submission of discrepancy report of investment approved and rejected by our auditors.

Reimbursement proof checking and processing

- Auditing of reimbursement proof submitted by employees.

- Submission of discrepancy report of approved and rejected proofs by auditors.

- Processing of reimbursement for payout as per the approved limits.

- Calculating and accounting the tax impact as per the IT Law .

Reach Us Out to help your growth!